Looking over some of the thousands of articles written about the current euro- area crisis and the impending Greek default some items are notably absent from the conversation:

The countries which carry the greatest debt burdens and have the least means to service and repay the debts are also Europe’s energy deadbeats. Don’t believe me, see for yourself:

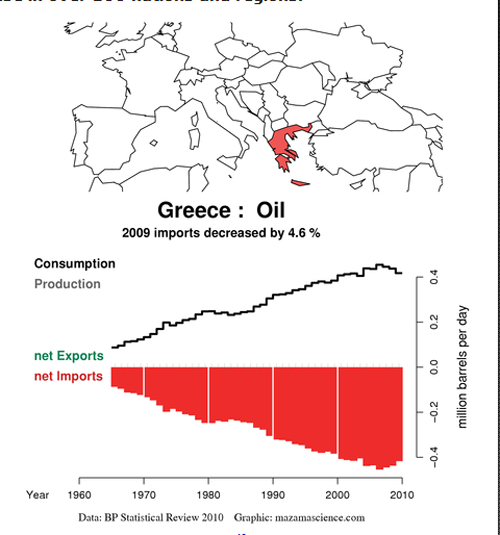

Figure 1: this chart is from Jonathan Callahan’s Energy Export Databrowser. Greece does not produce any petroleum energy to speak of: a few thousand barrels per day from offshore fields. It has to import fuel from overseas, mostly from Middle East producers such as Iran. Where does Greece get the hard currency to swap for petroleum overseas?

From an energy standpoint Greece is insolvent. It once borrowed — euros — from banks to buy fuel. Now it has to borrow from new banks to pay off the old banks AND to buy the fuel. Greece is on the road to oblivion. It buys less fuel even as it falls further into debt. Without some drastic change Greece will not only default but collapse.

Like the other countries, Greece obviously failed to earn enough from using the fuel to pay its energy bill otherwise it would not be insolvent.

Media mavens insist Greece is insolvent because its citizens evade taxes and European vampire capitalists don’t own enough of Greece’s productive assets. These assets did not produce a return for the Greeks, why would they produce a return for anyone else?

Greeks borrowed money to buy German and French cars and military hardware. The Germans and the French lent money — vendor financing — specifically for this purpose! The cars/hardware didn’t actually produce any useful returns, they are simply toys. The manufacturers profited by the sales and banks by extending the credit. Now Greeks and their government cannot pay. How can they pay? They have no productive assets, only useless waste- enablers and smog from the burnt fuel.

Germany and France are endangered by the Greek insolvency that they themselves promoted. When Greece cannot pay its bills, there is no collateral for Germany and France to collect, only some used cars.

Here’s another country:

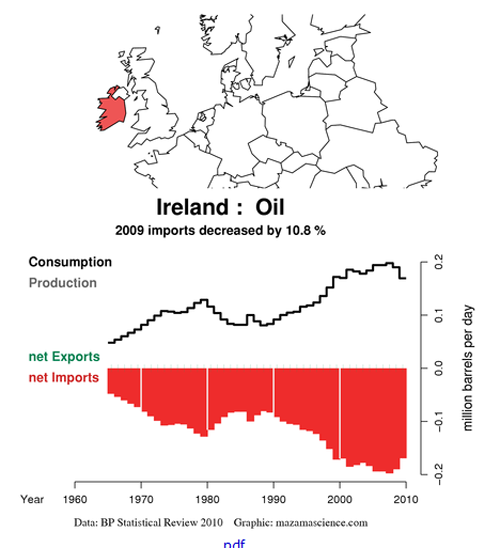

Figure 2: Ireland has zero producing oil wells although the media hypes Ireland’s ‘potential’. It must import every drop of motor fuel and has for as long as there have been motor cars. Ireland also does not manufacture anything except whiskey and beer. It’s a Euro tax haven for trans- national businesses. These don’t earn enough to pay Eire’s fuel bill. If they did, they would have been doing so already. For Ireland to obtain fuel it must borrow. Now it’s broke — from attempting to earn from its fuel consumption — and can only subjugate itself to the IMF and the ECB in order to service long- dead money. How long can this go on? Probably another year or three then Ireland along with Greece will be completely bankrupt.

It’s not enough for Eire to borrow to pay interest on defunct loans, it must borrow additional amounts simply to keep the lights on.

Like the other euro deadbeats, Ireland cannot escape the common currency. If it were to abandon the euro and issue its own currency it would not be able to buy fuel. A sharply depreciated punt would hardly be acceptable by the Saudis or the Iranians who can sell for high prices in hard currency. Ireland would have to buy euros or dollars on the foreign exchange markets at a severe discount. The F/X cost would be greater than the current austerity costs are to Ireland. Basically, Ireland has traded its present and future for the chance to drive luxury cars in circles between ugly houses for a little while.

Here’s another country:

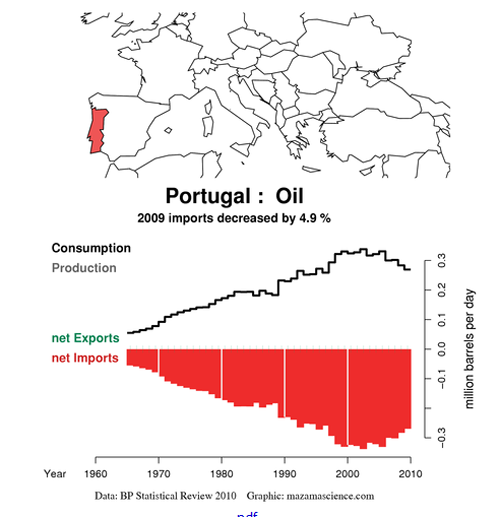

Figure 3: This country used to have a pretty strong export market for its fabric goods. The importation of euros accompanied a torrent of cheap Chinese textiles to both Portugal as well as to her customers. This was by way of China’s acceptance into the WTO with a yuan sharply under-priced relative to the euro. In a trice, Portugal found itself unable to earn enough foreign exchange — euros — to pay for its fuel. Now that China has destroyed Portugal’s ability to earn, it makes ready to lend Portugal additional euros at a high rate of interest, to add to the unpayable debts it already carries.

Like Ireland and Greece, Portugal is absolutely dependent upon both the euro and on euro- denominated loans to ‘afford’ fuel. No loans and these countries are on an instant — and crushing — energy diet.

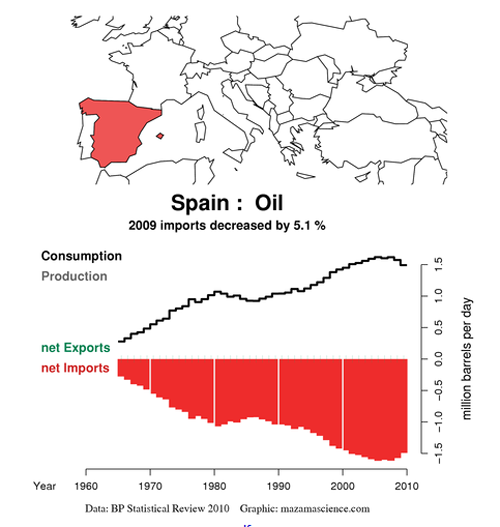

Figure 4: Spain has an oil field, perhaps more than one. Unfortunately, the Spanish are massively unbalanced on the import side. Cars are easier to come by than new oil fields. Euro- denominated credit enabled developers to clutter the Spanish countryside with millions of ugly boxes. The outcome is the Spanish cannot afford both the empty houses and the fuel … along with the interest on all the relevant loans. This is an example where ‘having it all’ really means ‘having nothing at all’.

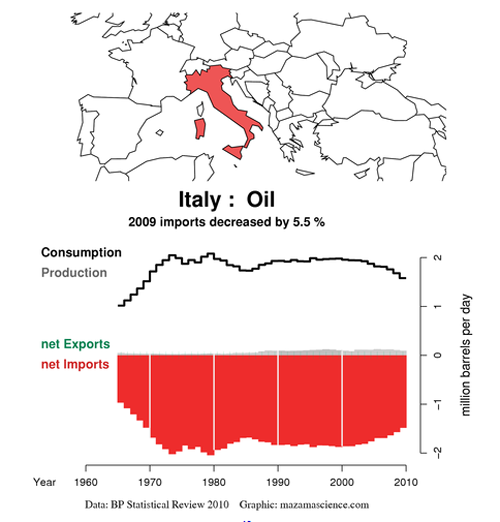

Here is the last of the PIIGS, Italy:

Figure 5: Italy actually has enough oil production to register on BP’s 2010 Statistical Review. This is likely a reason — a strong tourist industry is another — why Italy isn’t standing in a breadline. Italy also makes cars for domestic sale and export. By exporting cars, Italy digs its own grave: the cars it sells cannot earn anything for the cars’ users. The exceptions are deliverymen and taxi drivers, police and emergency workers who actually use cars to earn money. In this way, Italy and the other EU exporters cannibalize their export partners, by selling them goods that cost too much to make profitable use of.

Italy has also lost export business to the Chinese leviathan, which means an increase in its need for more credit.

The PIIGS together consume 4 million barrels per day x $100+ per barrel. This is about a billion euros a week sent to petroleum exporters. This in turn must be borrowed: no wonder the EU is broke.

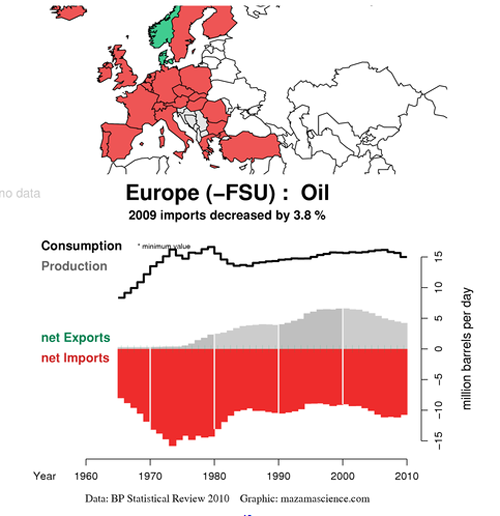

Figure 6: This chart has to get your attention! Except for Norway and Denmark the entirety of Europe is an energy debtor. The North Sea field that that supports Norway and Denmark is in terminal decline.

Note the similar declines in energy consumption among the peripherals and Europe as a whole. Europe is not necessarily more efficient: declining GDP leaves less funds — borrowed or otherwise — available for fuel for all countries.

What can be seen on these charts is energy conservation enforced by credit limits: when the credit runs out so does the fuel. Right now, Greece, Ireland and Portugal are on the way to being car- free. The rest of Europe is only slightly behind. As more countries become car- free, the manufacturing states will also fall insolvent. Germany and France without the export sales of Porsches, Peugeots and Benzes are Detroit with more picturesque ruins and nuclear reactors.

Here are a few things to keep in mind when you are reading articles about the European Debt Crisis:

– The flow of funds — euros — overseas toward energy producers in the Middle East and elsewhere represents a great portion of insolvent countries’ cash flow.– That the flow of funds between one European country and others in foreign currency — euros — represents another great portion of insolvent countries’ cash flow. These are the funds swapped for automobiles, auto- related ‘development’ and fuel- guzzling military hardware.

– The funds to energy producers is simply money borrowed then lost. There is no return other than that gained on the purchase/sale of the energy products. Money borrowed by the European establishment likewise produced no lasting return. Borrowing was for waste- enablers such as luxury cars, new highways, shopping centers, and American- style suburbs rather than capital for productive enterprises. In this light, the euro is a predatory instrument like a sub-prime mortgage.

– The Euro- nations with greater finance access are using this leverage to buy a small amount of time at the expense of their dependent trading partners. Meanwhile, the time- buying process destroys whatever goodwill the euro experiment earned since the currency union idea was bruited. Instead of accord, it is devil take the hindmost. What trust citizens had in their institutions is now a ruin in Syntagma Square crushed by an insensitive and counterproductive ‘Troika’.

– Ironically, the same countries’ workforces are now accused of being ‘uncompetitive’ by the same entities that rendered them uncompetitive. If there is a more perverse and diabolical dynamic it is hard to see what it is.

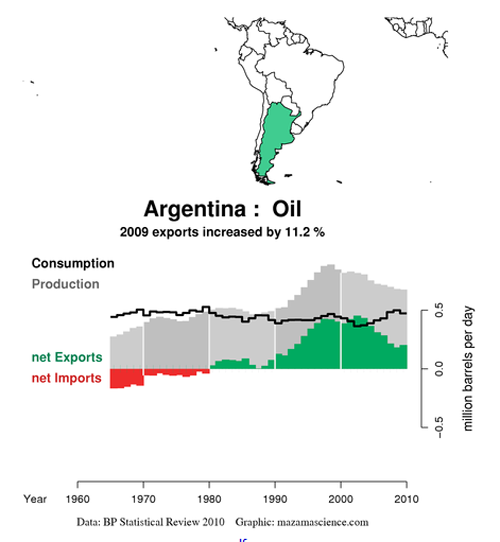

– The European countries at the edge of default cannot afford to do so. The Eurozone debtors cannot be compared to Argentina or Iceland as neither countries are energy debtors.

Figure 7: Argentina’s oil fields are productive but in terminal decline. In a few more years, Argentina will be an energy debtor like Italy, with sufficient oil production to bring back memories and nothing more.

Europe’s fuel- driven waste- based lifestyle is kaput, the goods bought and borrowed against for purchase are useless, the fuel used once then gone: all borrowed to gain this is noncollectable. The money has been spent and gone, it is ‘Dead Money’.